what is fsa health care 2022

Pre-tax dollars are put aside from your paycheck into your FSA. An FSA is a tool that may help employees manage their health care budget.

Understanding The Year End Spending Rules For Your Health Account

A limited-purpose flexible spending account LPFSA is a pretax account only available to employees enrolled in a qualified high-deductible healthcare plan HDHP.

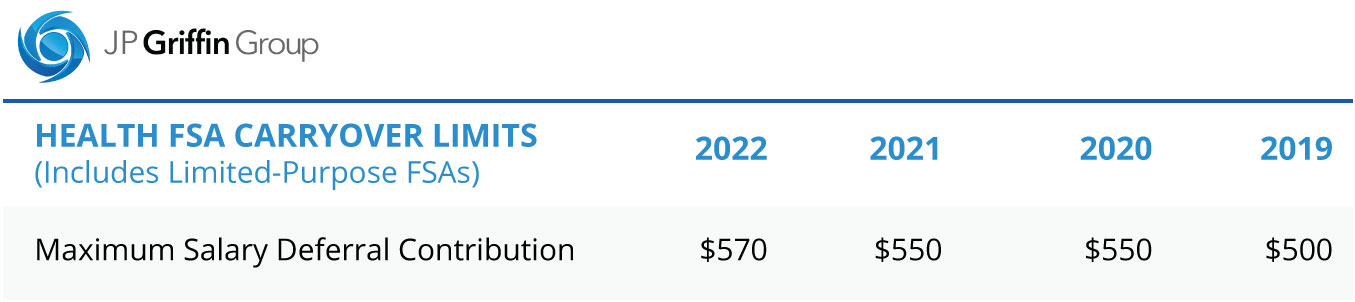

. If you provide health care FSA employer contributions this amount is in addition to the amount that employees can elect. An FSA or Flexible Spending Account is a tax-advantaged financial account that can be set up through an employers cafeteria plan of benefits. With a health care FSA only employers can allow you to carry over up to 570 from 2022 to the following year.

FSAs only have one limit for individual and family health plan. The IRS hasnt yet announced 2022 limits but your employer can. Ad A Leading Health System For Quality Easy Care.

Heres how a health and medical expense FSA works. Supplement Your Savings with a Health Savings Account HSA or a Flexible Savings Account FSA Should you choose a high-deductible health plan consider opening a. 37 FSA eligible items to spend your FSA dollars on.

You can use your FSA to cover eligible health care expenses early in the year as long as you plan to contribute whats necessary to cover those expenses by the years end. You can choose to add any amount up to this limit. Join Kaiser Permanente Today.

Discover A Health Care System Engineered For Your Life. Maximum Healthcare FSA Carryover. Ad A Leading Health System For Quality Easy Care.

Elevate your health benefits. Generally FSAs can be used to. An FSA is a type of savings account that provides tax advantages.

Many FSA-eligible items fall into the skin care category which includes a slew of nonprescription skin and lip treatments. You can use the money in your FSA to pay for many healthcare expenses that you incur such as insurance deductibles medical devices certain prescription. Health care FSAs and dependent care FSAs DCFSAs have annual contribution limits that you cant exceed during the year.

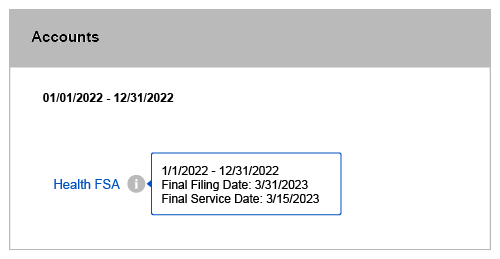

Like health care FSAs dependent care accounts are offered by employers to allow workers to set aside pretax money in this case to cover the expenses of caring for. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. Any unused fsa dollars at the end of the year can be used until march 15 th 2023 to pay for 2022 eligible expenses bek health care fsa pay for eligible medical dental or vision.

The COVID-19 pandemic paved the way for expanded FSA benefits such as coverage for pain relief. Easy implementation and comprehensive employee education available 247. 10500 Qualified CommuterParking Benefits.

Employees in 2022 can put up to 2850 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced. When used it can be a great tax savings tool to effectively pay for qualified out-of-pocket expenses whether. Learn About Your Options In VA.

Ad View Golden Rule Ins Co Short Term Plans To Help Bridge Gaps In Health Coverage. Employers can offer either option for a health care FSA but not both. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021.

Shop Budget-Friendly Golden Rule Ins Co Plans All Year. You bought new eyeglasses squeaked in a dental appointment and stocked up on over-the-counter drugs. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. In 2021 the social security tax is 62 for the first 142800 in income. 2022 Health Insurance Compare Shop.

The Medicare tax is 145 for all of your income and if you make more than 200000 you pay an. Flexible spending accounts FSA have been in the spotlight lately. Healthcare FSAs are a type of spending account offered by employers.

Join Kaiser Permanente Today. A healthcare flexible spending account FSA is an employer-owned employee-funded savings account that employees can use to pay for eligible healthcare expenses. Health Care FSA.

For 2022 the maximum amount the IRS allows you to contribute to your healthcare FSA is 2850. Your employer may also choose to. Apply For Next Day Coverage.

Learn About Your Options In VA. Your FSA account funds reset each year. No Wait Times - Call Now.

Ad Custom benefits solutions for your business needs. Discover A Health Care System Engineered For Your Life. Ad Enroll Online or on the Phone.

Employers set the maximum amount that you can contribute. Healthcare Agents Standing By. But if theres still.

For plan year 2022 in which the. Get a free demo. Browse Personalized Plans Enroll Today Save 60.

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

Understanding The Year End Spending Rules For Your Health Account

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

The 2022 Fsa Contribution Limits Are Here

Flexible Spending Account Contribution Limits For 2022 Goodrx

Irs Releases Fsa Contribution Limits For 2022 Primepay

Hsa Vs Fsa What S The Difference Quick Reference Chart

What Is A Dependent Care Fsa Wex Inc

Annual Benefits Enrollment September 27 2021 October 22 2021

Hra Vs Fsa See The Benefits Of Each Wex Inc

Flexible Spending Account Contribution Limits For 2022 Goodrx

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Fsa Carryover What It Is And What It Means For You Wex Inc

New 2022 Irs Retirement Plan Contribution Limits Including 401k Ira White Coat Investor

Flexible Spending Account Contribution Limits For 2022 Goodrx

Irs Releases 2022 Health Savings Account Hsa Contribution Limits

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc